Silence wants to shake things up when it comes to climate tech investment. This new angel-style VC firm has already raised $35 million and plans to make dozens of small investments in climate startups to help them apply the tech startup playbook.

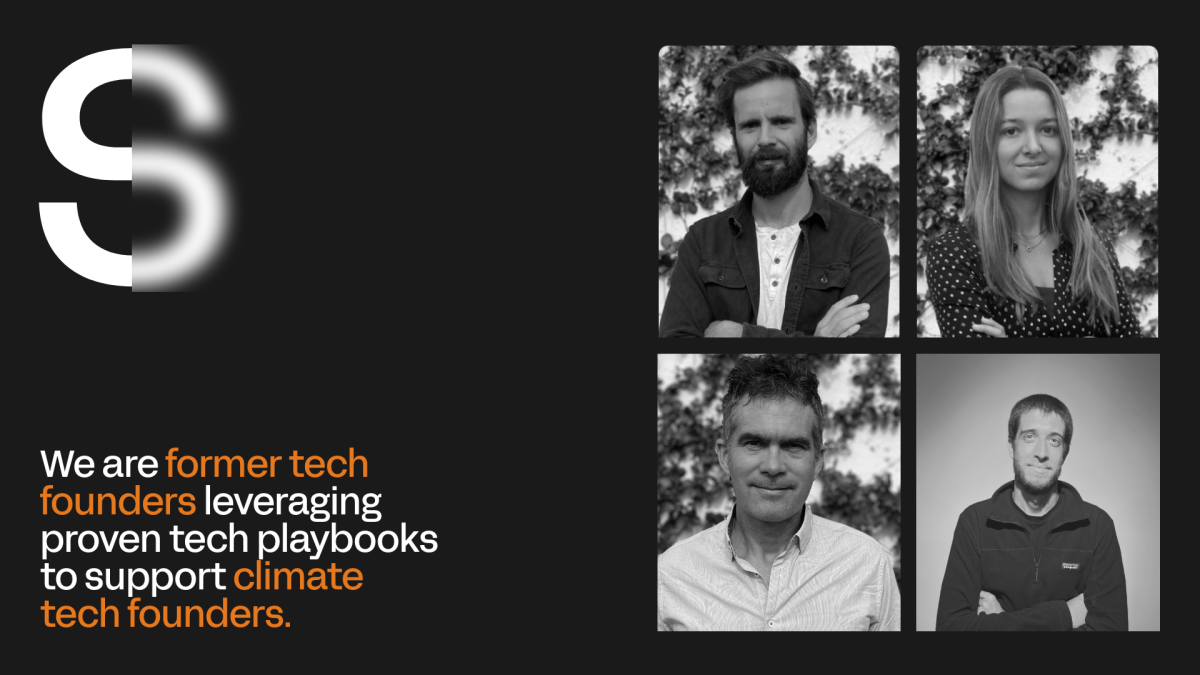

The Silence team is led by Borja Moreno de los Rios who acts as a solo general partner for Silence’s original fund. Before starting Silence, he was a venture partner at FJ Labs. He also founded Merlin, an hourly jobs marketplace in the U.S.

With Silence, Borja wants to apply his experience to climate investment. He has surrounded himself with a team of tech experts who have all done the work to become climate experts as well.

“I have been very connected to nature and the environment ever since I was a child. I grew up water-skiing competitively from a very young age. Since I was five or six years old, I spent every weekend and all my vacations by lakes and in the countryside,” Borja told me.

“But as I was growing through my tech career, I always had an eye on trying to learn as much as possible so I could really have an impact at the climate tech level. So after my last company got acquired, I knew that I wanted to do something in climate,” he added later in the conversation.

A silent partner

Since the first close of the fund in June 2022, Silence has already invested in 22 different companies. They apply the same investment strategy (with a few exceptions). Silence doesn’t lead rounds and doesn’t take board seats.

This way, they believe they can remain neutral and unbiased over the long run — just like an angel investor, but with a larger ticket size. “The average ticket size is around $300k. We invest from pre-seed to Series A and we invest anything from $100k up to $700k,” Borja said. There will be some follow-on investments for the most promising investments.

They also don’t compete with top tier VC funds, meaning that they can get invited to participate in very competitive deals. “We wanted to find a way so that we were not competing with the current VCs,” Borja said. For instance, Silence already participated in several rounds with well-known VC firms, such as Point Nine, FJ Labs, FifthWall, Firstmark Capital and Lowercarbon Capital.

I’m not going to list all portfolio companies (check the portfolio page), but Silence’s portfolio companies are building virtual power plants, energy management systems, home energy management systems, financing platforms for solar equipment and circularity-focused marketplaces.

“There’s one that just grew really fast. And we’re very proud because we invested in pre-seed and we never lead deals. But in this case, the company was struggling to close a round because everyone was saying ‘we’ll put money only if you find a lead.’ And no one wanted to be the lead. So we told them ‘we’ll be your lead,’” Borja said.

“This is a company called Cardino, which is a used EV marketplace. So we invested with just the deck, and they’re doing like €72 million in GMV in nine months. And now they raised a seed round with Point Nine leading the seed. So obviously, it’s super early, but so far so good.”

In addition to Borja, Sara Ramos Colmenarejo left the Hummingbird team to join Silence. Guilherme Penna, who previously worked at Global Founders Capital, is also an investor at Silence. Finally, Brendan Hayes acts as the CFO and COO for the fund.

Silence’s limited partners include general partners at other VC firms, such as Firstmark Capital, DST Global, FJ Labs, Point Nine and Hummingbird, as well as family offices, successful founders, etc. Overall, Borja seemed like an enthusiastic investor. Even though Silence wants to remain a small angel-style investor, he couldn’t stop listing some of his portfolio companies.

“There’s a company called Electryone that’s really early that’s building a virtual power plant software that we’ve invested in and we really like,” he said. “We also invested in a company called Runwise in the U.S., which basically has built a technology that integrates with the heating system in a building and then has sensors around the building and is constantly optimizing the temperature.”

Interestingly, unlike many climate funds, Silence doesn’t want to participate in deep tech investments with a very long-term timeframe. Borja believes Silence’s expertise is in SaaS and marketplaces.

“In the end — I know this is kind of controversial — but, in the end, I think we are going to be creating more value towards climate through these safer investments than if we invest in ten moonshots and all of them fail,” he said.